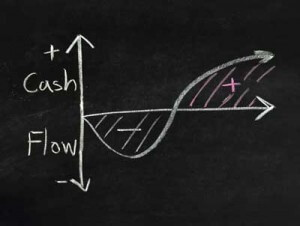

If your business is selling products or services to other businesses on standard trade/credit terms, then Cash Flow/Debtor Finance may be a suitable option for you. Cash Flow Finance is an option that will allow you to receive payment for up to 80% of the value of your invoices within 24 hours, with the balance provided when your customer pays your account.

The Alliance Group consultants are well versed in Cash Flow / Debtor Funding as it has assisted so many of our existing clients to achieve their aspirations by providing cash flow solutions and freeing them from the constraints of traditional banking. It provides a flexible cash flow facility that will help your business grow.

The Alliance Group consultants are well versed in Cash Flow / Debtor Funding as it has assisted so many of our existing clients to achieve their aspirations by providing cash flow solutions and freeing them from the constraints of traditional banking. It provides a flexible cash flow facility that will help your business grow.

Why is Cash Flow / Debtor Finance a good option?

- Leverage your own debtors to enhance your cash flow position.

- Debtor Finance, unlike overdrafts, does not require real estate security

- As your business grows, the finance facility grows with it

- Fast access to your debtor’s outstanding invoices – no more waiting 30 or 60 days.

- Debtor finance is a self-liquidating facility, meaning that your company isn’t taking on any additional debt

- It is a stand-alone facility that can sit alongside other business borrowings (such as long term loans, leasing)

This type of funding is extremely beneficial to a lot of medium to large enterprises who wish to grow their business or need some cash flow support. It far outweighs that of an overdraft style facility which usually has a capped dollar figure linked with your security property value. Cash flow / Debtor funding does not normally require property as security and its loan value is fluid spending on the value of your outstanding invoices.

Talk to one of our experienced Cash Flow Finance consultants to discuss whether this option is suitable for your business.